Not known Facts About Estate Planning Attorney

Table of ContentsEstate Planning Attorney Can Be Fun For EveryoneThe Ultimate Guide To Estate Planning AttorneyThe Estate Planning Attorney Diaries6 Easy Facts About Estate Planning Attorney Described

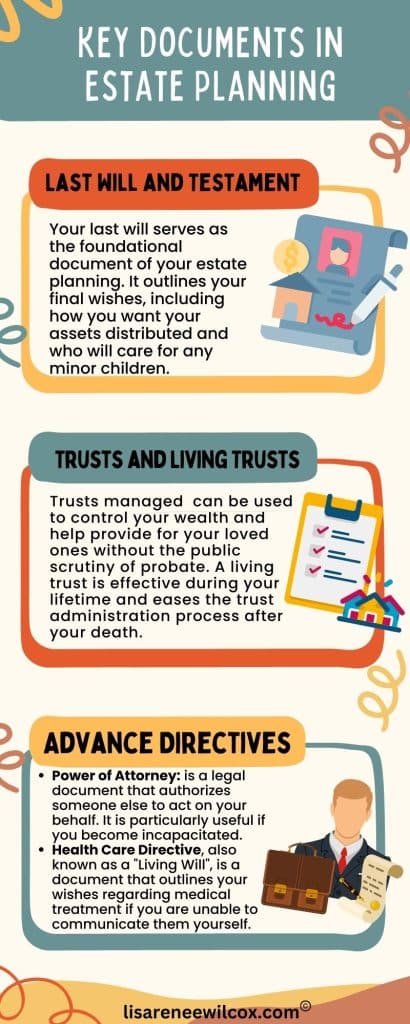

Estate planning is an action plan you can use to establish what happens to your assets and responsibilities while you're to life and after you pass away. A will, on the other hand, is a legal record that describes just how properties are distributed, who cares for children and animals, and any type of other wishes after you die.

Claims that are declined by the executor can be taken to court where a probate judge will have the last say as to whether or not the case is legitimate.

Some Ideas on Estate Planning Attorney You Need To Know

After the stock of the estate has been taken, the value of assets calculated, and tax obligations and financial debt repaid, the executor will then look for permission from the court to distribute whatever is left of the estate to the beneficiaries. Any estate taxes that are pending will come due within nine months of the day of fatality.

Each individual places their assets in the trust and names someone various other than their spouse as the beneficiary. A-B trust funds have actually come to be much less prominent as the inheritance tax exception functions well for the majority of estates. Grandparents might move possessions to an entity, such as a 529 plan, to sustain grandchildrens' education and learning.

All About Estate Planning Attorney

Estate coordinators can deal with the benefactor in order to decrease taxed earnings as an outcome of those contributions or create techniques that make the most of the result of those donations. This is an additional technique that can be made use of to limit death tax obligations. It involves an individual securing the existing value, and therefore tax obligation obligation, of their property, while associating the worth of future growth of that funding to an additional individual. This technique entails cold the value of a property at its value on the day of transfer. Accordingly, the amount of prospective resources gain at check my blog fatality is additionally frozen, permitting the estate planner to estimate their prospective tax obligation responsibility upon death and much better prepare for the settlement of income taxes.

If adequate insurance coverage proceeds are offered and the plans are effectively structured, any income tax on the considered dispositions of properties following the death of an individual can be paid without resorting to the sale of assets. Earnings from life insurance policy that are gotten by the beneficiaries upon the fatality of the guaranteed are normally revenue tax-free.

There are particular records you'll require as part of the click for more estate planning process. Some of the most typical ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a misconception that estate planning is just for high-net-worth people. That's not real. Actually, estate preparation is a device that every person can use. Estate intending makes it less complicated for people to determine their dreams prior to and after they die. In contrast to what lots of people believe, it extends beyond what to do with properties and responsibilities.

3 Easy Facts About Estate Planning Attorney Described

You need to start preparing for your estate as soon as you have any kind of quantifiable property base. It's an ongoing procedure: as life progresses, your estate strategy should shift to match your conditions, in line with your new objectives. And maintain it. Refraining from doing your estate preparation can cause unnecessary economic concerns to loved ones.

Estate planning is usually taken a tool for the rich. However that isn't the instance. It can be a valuable way for you to take care of your properties read more and responsibilities prior to and after you pass away. Estate preparation is also a great method for you to set out prepare for the treatment of your small kids and pets and to detail your long for your funeral and favored charities.

Qualified applicants that pass the exam will be formally accredited in August. If you're qualified to sit for the exam from a previous application, you might file the brief application.